2023 October Industry Insights & Best Practices

In October, top luxury brands focused on the following key themes: Luxury Brands Q3 Performance and Highlights, and Luxury Brands Ongoing Commitment to Empowering Sustainable Fashion.

Overview

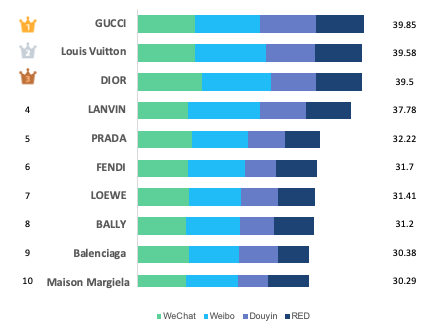

Curio Eye™ Brand Index: Top 10 best performing brands

The Top 3 best-performing brands in October were GUCCI, Louis Vuitton, and Dior.

GUCCI maintained the top position by unveiling the Gucci Horsebit 1953 collection to pay homage to the 70th anniversary of Gucci loafers, featuring global brand ambassador Xiao Zhan in an advertisement. Furthermore, GUCCI introduced the Gucci Horsebit Chain handbags.

Louis Vuitton unveiled its latest cultural month in Shanghai dubbed “Nóng Hó, Shanghai”, generating much attention and buzz. Additionally, the brand launched its Women‘s Spring-Summer 2024 Show.

DIOR gained significant engagement by unveiling the 2024 Ready-to-Wear collection and MISS DIOR handbags, enlisting an array of influential celebrities to showcase them.

LANVIN's announcement of Cheng Yi as its global brand ambassador resulted in the highest growth rate among the top ten brands.

PRADA, FENDI, LOEWE, and BALLY attracted attention through the FW23 collection, while Balenciaga and Maison Margiela launched the SS24 show.

Luxury Industry Trends

Luxury Brands Q3 Performance and Highlights

Recently, major luxury brands and groups have successively announced their third-quarter financial reports. Among them, the organic revenue growth rate of LVMH Group was 9%, reaching 19.964 billion euros, which declined from the 17% growth in the second quarter; Kering Group‘s overall revenue fell by 13%. However, brands and group such as Hermès and Zegna have maintained strong growth. The performance of luxury brands and conglomerates exhibited a clear differentiation.

Data Source: Published Financial Reports

1 Value is calculated based on Financial Reports 2 Richemont and Brunello Cucinelli’s YoY is based on current exchange rates and others YoY changes at constant exchange rates.

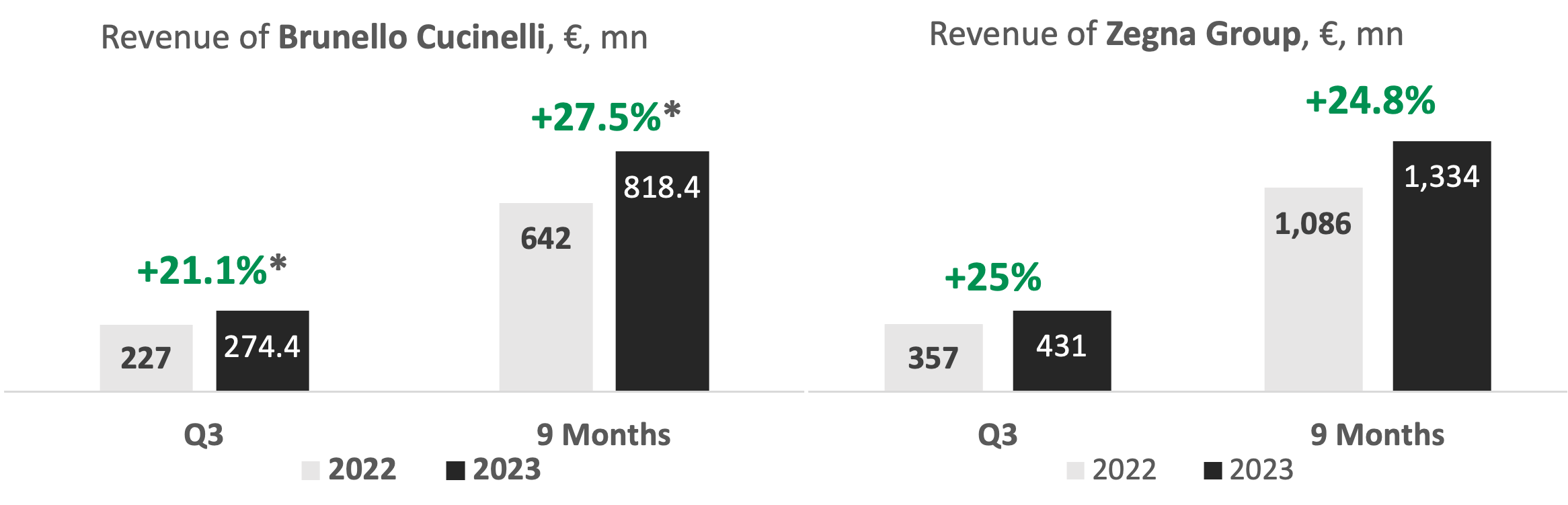

Quiet Luxury Style Continues to Grow

The representative brands of the quiet luxury style, Brunello Cucinelli, and Zegna saw their revenue rise in Q3 and the first 9 months of 2023. Kering’s brand Brioni and LVMH’s brand Loro Piana also saw up sales driven by its tailoring as well as leisurewear offerings. These positive figures show the market’s current pursuit of quiet luxury style. Logo mania is no longer the sole indicator of market trends.

Data Source: Published Financial Reports

* Brunello Cucinelli YoY is based on current exchange rates and other YoY changes based on constant exchange rates.

Hard luxury Shine Bright

The revenue of Hermès Group’s Watches business line and the Other Hermès business line which includes the Jewellery sector increased 23.5% and 26.4% YoY respectively, exceeding the overall revenue YoY rate of 21.7% in 9M 2023. Hard luxury confirmed its strong performance and leading status in this period.

LVMH’s jewelry Maisons maintained strong growth, while Tiffany continued its store network renovation program worldwide. Bulgari and Chaumet held exhibitions around the world, and Tiffany, Bulgari, and Fred unveiled their new jewelry collections. To highlight watchmaking, Hublot has collaborated with the FIFA Women’s World Cup.

For Kering Group’s jewelry brands, Boucheron’s positive performance reflects the success of its High Jewelry collections. Pomellato achieved solid growth in its stores, while Qeelin showed excellent momentum.

Data Source: Published Financial Reports

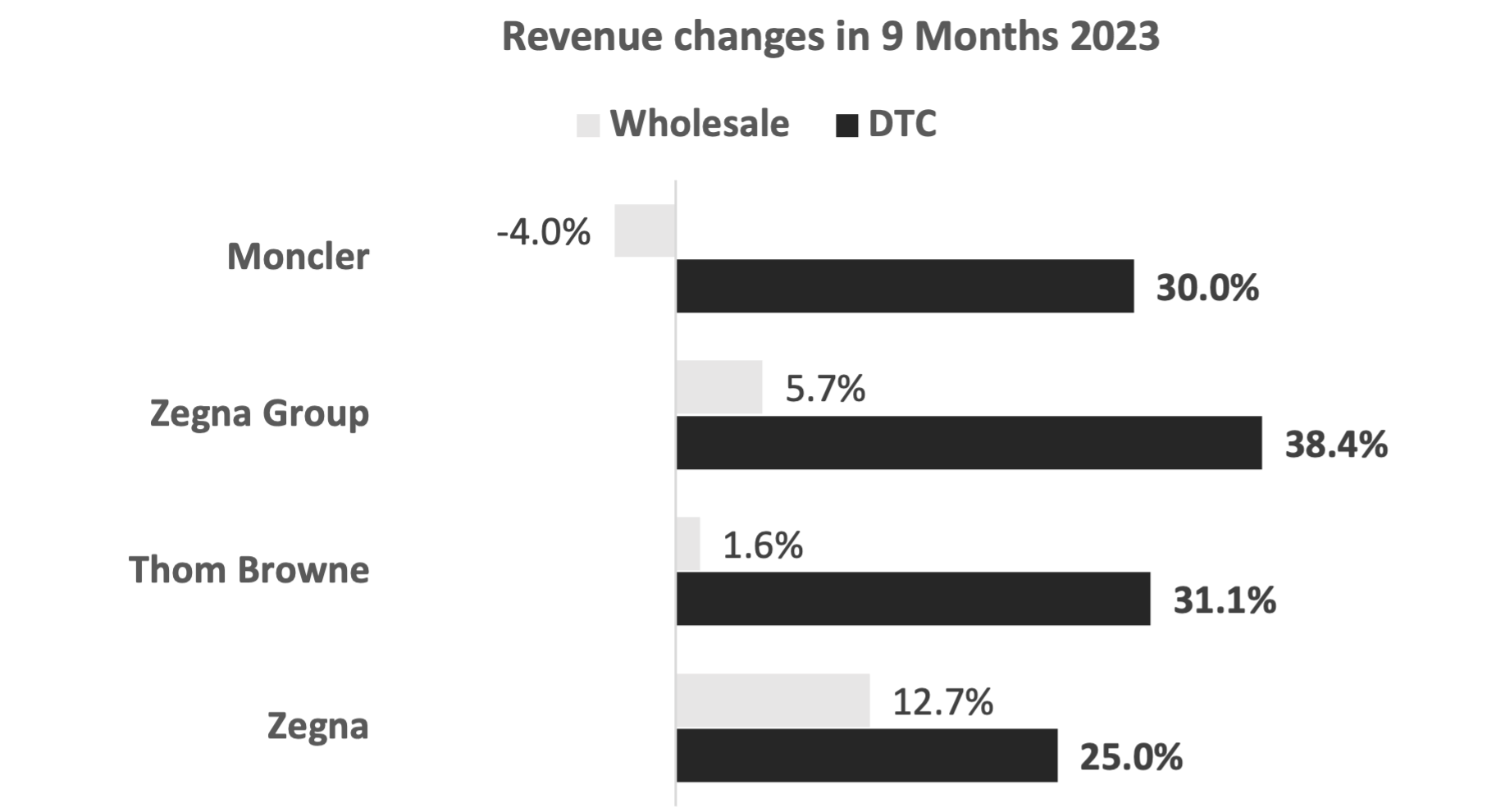

Switch to DTC

Moncler got solid growth in the first 9 months of 2023, driven by the ongoing strength of the DTC channel, which continued to grow at a very solid pace with a positive contribution from all regions, only partially affected by a deterioration in the performance of the direct online channel in the EMEA region.

Zegna Group’s DTC revenue represents 64.8% of Group revenues in the first 9 months of 2023. For DTC revenues by brands, the growth of Zegna’s DTC revenue was driven by a continued improvement in in-store productivity, and Thom Browne’s DTC revenue reflects the shift of the South Korean business from wholesale to DTC.

Data Source: Published Financial Reports

APAC Has Enormous Growth Potential

Brunello Cucinelli’s Asia sales account for 26.7% of the overall revenue. Revenues in Hong Kong were mainly supported by domestic demand and tourism.

Prada’s revenue in APAC rose on a volatile basis of comparison in 2022, remaining at a double-digit level during the third quarter (+13.5%), with higher growth in Hong Kong and Macau.

Moncler’s Asia Q3 and 9 months revenues normalized from Q2 due to a tougher comparable base in the Chinese mainland, whose performance in Q3 2022 was boosted by the end of several Covid-related lockdowns.

Ralph Lauren’s revenue increased 1.7% in Q3 2023, led by continued momentum in Asia (+12.6%).

Data Source: Published Financial Reports

1 Value is calculated based on Financial Reports

China Is Still The Growth Engine For Certain Brands

Richemont growth was led by Asia Pacific where sales rose by 14% fueled by a 23% progression in mainland China, Hong Kong, and Macau combined over the last 6 months ended 30 September.

Accounting for about 70% of the APAC market, China is the main contributor to the regional revenue, keeping the same pace with the growth of Zegna’s APAC sales in Q3 and 9 months in 2023.

China now accounts for about half of Brunello Cucinelli’s Asia market, confirming the outstanding growth trend (+49.7% in APAC).

Ralph Lauren saw its continued momentum in the Asia region with China up more than 20% than last year.

Data Source: Published Financial Reports

Executives Outlook In China - Promising Future

Ermenegildo Zegna, Chairman and CEO of the Zegna Group, conveyed his confidence in the continued progress of the Zegna rebranding, including the full implementation of the One Brand strategy in China, the expansion opportunities for Thom Browne, and the integration and evolution of TOM FORD FASHION.

Eric du Halgouet, executive vice president of finance at Hermès, revealed that Hermès will continue to invest in China at the rate of opening one or two new boutiques per year.

Jean-Jacques Guiony, CFO of LVMH, stated that the Chinese market has recovered rapidly, faster than any other region globally, and has returned to pre-pandemic levels. LVMH Group will also focus on the DFS project in Sanya, Hainan, to further strengthen its presence in China.

Luxury Brands Ongoing Commitment to Empowering Sustainable Fashion

In October, Prada Group, Kering (which oversees Gucci, Saint Laurent, Bottega Veneta, Balenciaga, and so on), Stella McCartney, and Armani have remained committed to sustainable fashion by hosting various events such as exhibitions, awards ceremony, and new collection launch. They are breaking away from traditional thinking and transforming sustainability from a mere differentiating factor into a universal brand consensus.

Image Source: Prada & Kering & Stella McCartney & Armani Official Weibo Account

CURIOSITY SPOTLIGHT

Why sustainable fashion? On one hand, the fashion industry is responsible for approximately 4-10% of global emissions1, making environmental preservation an urgent priority. On the other hand, embracing sustainability can yield better rewards for brands.

As Chinese consumers increasingly prioritize sustainability, luxury brands that embrace sustainable fashion gain a competitive edge in capturing the attention of key demographics, particularly Generation Z and Millennials.

Through the continuous innovation of sustainable practices, ranging from sustainable fabrics to circular economy initiatives, the fashion industry is driving collaboration across multiple sectors and advancing.

1 Roland Berger X WWD - Sustainable-Fashion-White-Paper

Prada Group and IOC/UNESCO took the “Ocean & Climate Village”, an integral part of the United Nations "Decade of Ocean Science for Sustainable Development (2021-2030)" initiative, to China from October 14th to 15th, at the Qingdao Haitian Center.

Over the past three years, this exhibition has graced prestigious locations such as the Milan Triennale, the Venice Arsenal, and the Ovo Castle in Naples. The selection of Qingdao, one of the most important Chinese coastal cities, home to prestigious marine research centers, highlights Prada's keen understanding of China's urban landscape.

The event encompassed two live panel discussions centered around sustainable ocean development, as well as an interactive exhibition open to the public. Rather than solely focusing on cultivating consumer environmental awareness, Prada Group specifically focuses on engaging the younger generation, especially schoolchildren, through children's workshops.

Image Source: Prada Official Weibo Account and Website

1 Prada Group official website 2 Powered by Curio Eye data, sourced from social media platforms (Weibo, WeChat, RED) in October 2023.

Kering and the global innovation platform Plug and Play China successfully held the third “Kering Generation Award” Ceremony at the Museum of Art Pudong on 16 October 2023. Since launched in 2018, the Kering Generation Award has been committed to supporting Chinese sustainable startups. Under the theme "Coming Full Circle", the third “Kering Generation Award” focuses on three dimensions: circular raw materials, circular product designs, and circular business models.

Stella McCartney made its first-ever presentation in Asia with the exhibition "Future of Fashion: An Innovation Conversation with Stella McCartney." As part of the exhibition, "Stella's Substantial Market" featured six booths that were brought to Shanghai, offering a unique and immersive experience.

Armani, on the other hand, launched the Emporio Armani FW23 sustainable collection, drawing inspiration from the ocean and incorporating eco-friendly materials and techniques.

Image Source: Kering Official WeChat & Weibo Account, and Stella McCartney & Armani Official Weibo Account

Campaign Best Practices

Louis Vuitton “Nóng Hó, Shanghai” Culture Travel Month

OVERVIEW

As a brand that has a heritage of manufacturing traveling luggage, TRAVEL has always been Louis Vuitton's distinctive DNA and a core element.

This year, Louis Vuitton unveiled its latest cultural month in Shanghai dubbed “Nóng Hó, Shanghai”,which is “Hello, Shanghai” in the local dialect, featuring a pop-up space by Suzhou Creek and various events celebrating the brand, the city, and the culture of Shanghai for a month, starting from October 12.

The event specializes in the new debut of the Shanghai edition of the Louis Vuitton City Guide series, which has been created since 1998, and takes viewers on an in-depth journey through Shanghai, offering a comprehensive, multi-sensory, and immersive experience.

Image Source: Official Weibo, WeChat Account, Official Website

OFFLINE EVENT

Nestled on the banks of Suzhou Creek, a landmark waterway of Shanghai, Louis Vuitton built a multi-functional “Nóng Hó, Shanghai” pop-up space at the newly-built Fotografiska Shanghai, converted from a historic warehouse built in 1931.

Image Source: Official Weibo, WeChat Account, Official Website

ONLINE PODCAST

Louis Vuitton launched its first-ever Chinese-language podcast series Louis Vuitton [Extended] on the Chinese podcast platform Xiaoyuzhou exclusively, delving into the city’s history, local characteristics, and hidden gems through the eyes of local Shanghainese cultural influencers, taking listeners on a unique audio city walk.

This is not the first time Louis Vuitton has used sound as its unique branding medium in China.

Back in 2008, Louis Vuitton launched the album SoundWalk, featuring 3 love stories set in Beijing, Hong Kong, and Shanghai narrated by Gong Li, Shu Qi, and Joan Chen, respectively. Along with the romantic tales, the album linked regional walkable urban landmarks, leading listeners to explore the city through the narrators’ voices.

Image Source: Xiaoyuzhou, NetEase Music

CURIOSITY SPOTLIGHT

The current demographic profile of Chinese podcast listeners overlaps significantly with the target segment of luxury goods, representing the lucrative potential purchasing power of Chinese podcast users. The launch of Louis Vuitton [Extended] can be regarded as Louis Vuitton’s in-depth insight and quick response to the Chinese market.

WHY Podcast? Podcasts have emerged as a platform to carry out community operations and cultural expression and narrow the distance with the audience, at the same time guaranteeing the depth of the content and conforming to the diversified life scenarios of modern people such as driving.

1 Observations on Chinese Podcasts 2022, JustPod

FOOD FOR THOUGHT

City & Culture

Louis Vuitton creatively showcases city culture through various mediums, including books, SoundWalk, exhibitions, and pop-ups. This approach cultivates a distinctive city-centric brand identity and reaches millions of urban residents. These immersive cultural initiatives foster a profound, long-lasting connection with consumers, despite the absence of immediate benefits.

Localization

Louis Vuitton, known for its expertise in blending brand heritage with local cultures, approached this new project from a localized and inclusive standpoint. Through digital and physical initiatives, the brand revitalizes local communities and creates meaningful cultural moments with local consumers. In an era where luxury brands prioritize localization, the most successful ones go beyond marketing to establish genuine connections and enrich local communities.

Shanghai

Being the center and the biggest market for luxury goods in China, Shanghai, exposed to the luxury culture from Europe early, represents the emerging culture of China's young generation. There is little wonder the brand keeps tapping into both the traditional and global sides of the city.

With 7 stores already established in Shanghai, the brand's strategy remains coherent as evidenced by the recent opening of a home furnishing showroom in Zhang Yuan and a series of limited-time bookshops, showcasing their commitment to the city's diverse offerings.

CURIOSITY SPOTLIGHT

Louis Vuitton continues its hyper-localization strategy in China, condensing its timeless spirit of travel into a city unit. Instead of mounting a grand showcase featuring explosive items, the house chose to offer intimate, experiential, and immersive expression that keeps pace with the city and local consumers, integrating the brand’s legacy into the local ecosystem.

Image Source: Official Weibo, WeChat Account

Porsche Esports Challenge China (PECC) 2023

On October 30th, the Porsche Esports Challenge China (PECC) 2023 season concluded successfully at drivepro lab (MOTE) in Shanghai. The thrilling final race brought together 60 contestants who competed using racing simulators and PS5s provided by ALIENWARE.

With over 14,000 participants, the season spanned five months of intense competition. Through strategic collaboration with universities in virtual racing, PECC delves into the realm of young e-sports enthusiasts and potential future customers, establishing an e-sports ecosystem and paving the way for the digital future of motorsport while expanding the reach of Porsche Motorsport.

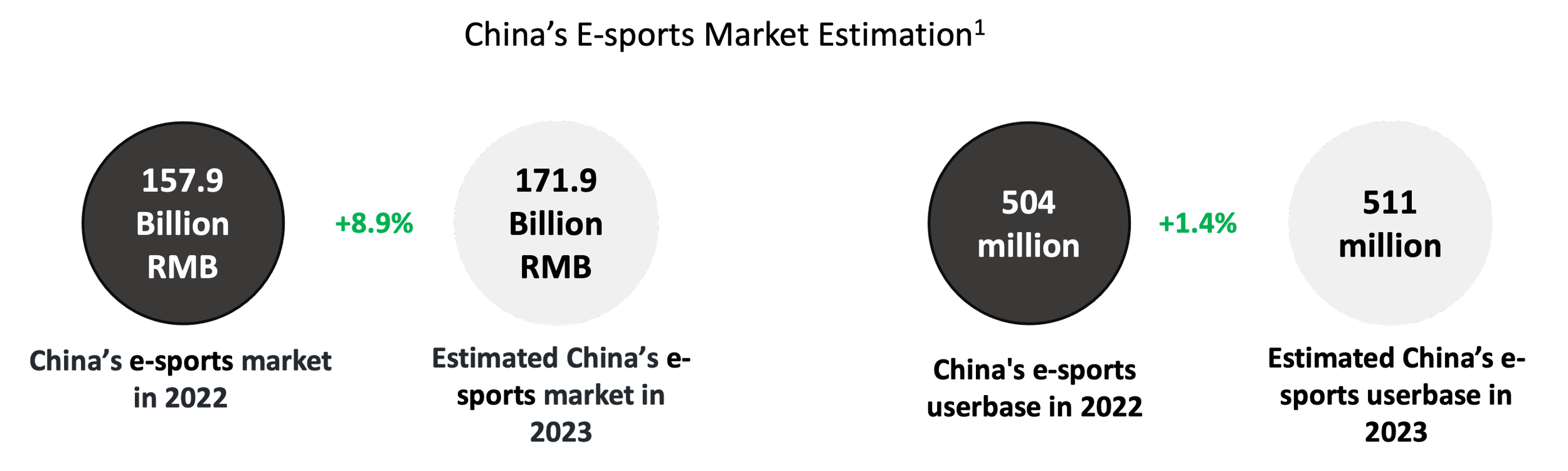

1. Tapping into the expanding gaming community

With the upcoming launch of e-sports programs at the 19th Asian Games in Hangzhou, this industry is poised for further growth. PECC serves as China's inaugural virtual racing single-brand event. With a lower entry threshold, it offers more enthusiasts the opportunity to engage with racing e-sports, allowing Porsche to tap into the expanding gaming community in China. This initiative aims to create a dedicated Porsche China racing gaming community, amplifying the brand's influence among younger generations of gaming enthusiasts, e-sports players, and sports car fans.

1 iResaerch – China E-sports Industry Report, 2023

2. Cultivating potential consumers through collaborating with esteemed universities

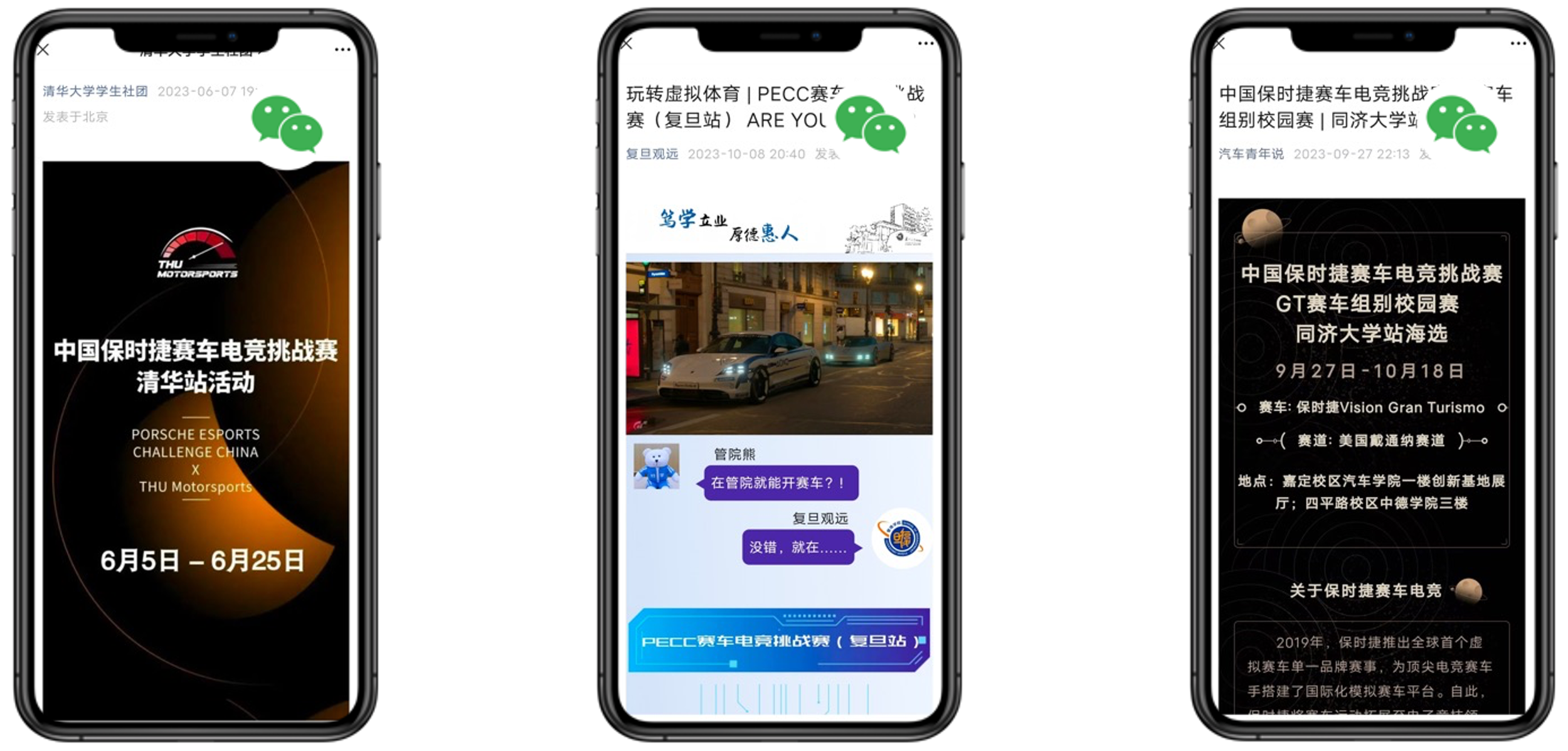

In the 2023 season of PECC, a notable trend emerged with over 88% of participants belonging to the post-90s generation. To broaden its reach and connect with top university students, the event collaborated with prestigious institutions like Tsinghua University, Tongji University, and Fudan University for campus auditions. This strategic move allowed Porsche to introduce its brand culture and philosophy to potential future consumers while gaining a competitive edge in establishing lasting connections with the next generation.

3. Offering immersive experience with Porsche masterpieces

In addition to the event, attendees were treated to a remarkable display of nearly 50 iconic Porsche models on a display wall, featuring highlights such as the Porsche Taycan Turbo S and the exclusive Porsche Vision Gran Turismo designed specifically for virtual racing. To further enhance the excitement, a professional racing simulator was open to the public, allowing visitors to immerse themselves in the exhilarating experience of driving a Porsche race car firsthand.

4. Radiating to a wider audience through multi-channel promotion

PECC races were livestreamed on platforms such as Weibo, WeChat, Douyin, and Bilibili. The event also made noteworthy appearances at well-known gaming and entertainment exhibitions in China, including Bilibili World and China Joy. Additionally, three GT racing city tours were organized this year, which radiated the glamour of motorsports to a large number of e-sports and gaming enthusiasts, expanding the influence of the event to reach an even wider audience.

Enjoying the reading? Please click below to download the full report.