Unlocking the Secret to Tourism Spending: Strategies to Capture the Attention of Chinese Travelers

Foreword

In 2023, the tourism industry experienced a resilient recovery and gradually returned to near pre-pandemic levels, thanks to supportive policies and the “revenge traveling” psychology. It is anticipated that in 2024, there will be a significant increase in the number of travelers and their spending on tourism. The 2024 Spring Festival is expected to lead to a surge in Chinese tourist travel, positively impacting both domestic and outbound tourism markets.

However, evolving preferences and behaviors adopted throughout the pandemic years mean Chinese travelers will likely travel and shop differently than before:

Emerging inbound and outbound travel trends, like the “3C” trend, Ice and Snow, etc.

Current performance of popular travel destinations among Chinese travelers such as Hainan, Hong Kong, Macau, ski resorts, Thailand, etc.

Shifts in consumer behaviors related to travel expenditures.

To effectively attract Chinese travelers, brands must swiftly harness insights from social big data to identify emerging trends in Chinese travel. This enables them to develop tailored marketing campaigns and create unique experiences that align with the evolving preferences of these travelers.

Chinese Travelers Market: Resilient Recovery and Promising Outlook

Promising Travel Market: Increased Mainland And Outbound Travelers Drove Consumer Spending In 2023, Reaching Or Surpassing 2019's Figures

1. The Minister of Culture and Tourism of the People’s Republic of China and the Exit-Entry Administration of the People's Republic of China. 2. Carat 3. National Immigration Administration 4. Alipay. The images were organized and drawn by CuriosityChina.

2024 Spring Festival: Anticipated Surge In Chinese Tourist Travel, Boosting Domestic And Outbound Tourism Markets

1. The data in the images is derived from the Minister of Culture and Tourism of the People’s Republic of China. The image was organized and drawn by CuriosityChina. 2. The data in the images is derived from reports of Trip.com Group Ltd and Alipay. The image was organized and drawn by CuriosityChina.

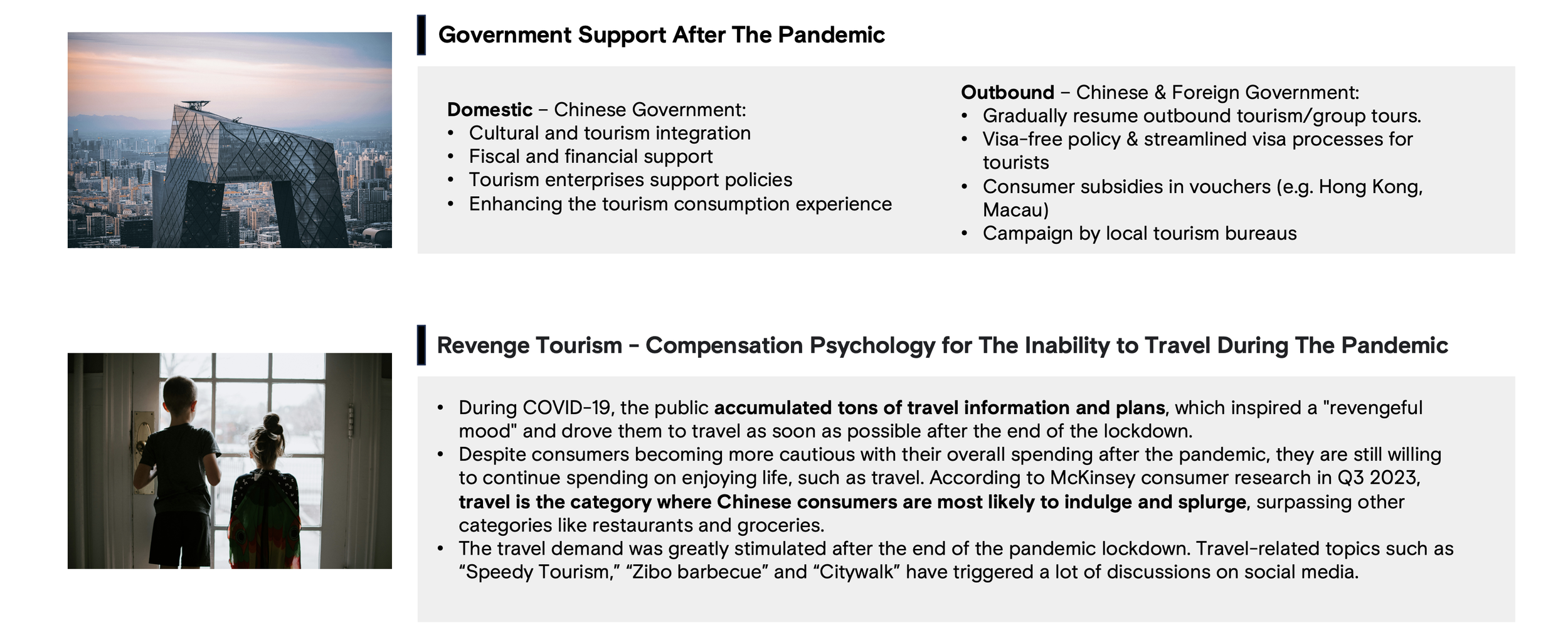

The Psychology Of “Revenge Traveling” And Self-reward, Along With Favorable Policies, Drives The Prosperity Of The Tourism Market.

Domestic Travel Trends: “3C”, Staycation, Snow-play vs. Winter Escape

Through The 3C Trends, Travelers Are Discovering A More Beautiful, Culturally Profound, Unique, And Diverse China.

#City Walk

Focusing on first-tier cities, the “city walk” combines the enjoyment of city architecture, dining, entertainment, shopping, and leisure activities. It is a popular and casual way of travel for modern people. #City Walk triggered 3.7M+ posts on RED in 2023 and the search volume of “City Walk” grew 140 times YoY (1).

#Countryside Tourism

This trend focuses on rural areas. The number of bookings for Countryside Tourism hotels nationwide has increased by more than 4 times compared to the same period before the pandemic (2019)(2).

#Culture Tourism

Focusing on music, food, and cultural performances, this trend represents travelers' desire to immerse themselves more deeply to understand and experience the diverse culture of China.

1. Data Source: RED 2.Data Source: Ctrip

Individuals With A Certain Level Of Purchasing Power Are Inclined To Choose Low-energy ”Staycation“ Trips To Alleviate Work-related Stress, Which Provides Vast Potential For High-end Hotels And Resorts.

#Staycation

Emphasizing a sense of relaxation.

Focusing on the experience of having a vacation spent in a hotel, which is also a hot topic on social platforms.

Staycation presents both opportunities and challenges for high-end hotels and resorts. As travelers seek better experiences and adopt more rational consumption patterns, hotels must offer high-quality services, distinctive environments, and culinary or experiential offerings that showcase local culture to set them apart from other establishments.

Seasonally, There Are Two Main Contrasting Trends During Winter For The Upcoming CNY: Snow-play Vs. Winter Escape

#Snow Play

Travel to Northern China for activities related to snow like skiing, sightseeing, etc.

Harbin, the capital city of Heilongjiang province in northeastern China, has recently gained tremendous popularity on social media platforms, primarily due to its abundant ice and snow activities.

Ski resorts like Changbai Mountain, Songhua Lake, Xinjiang, etc. remained popular.

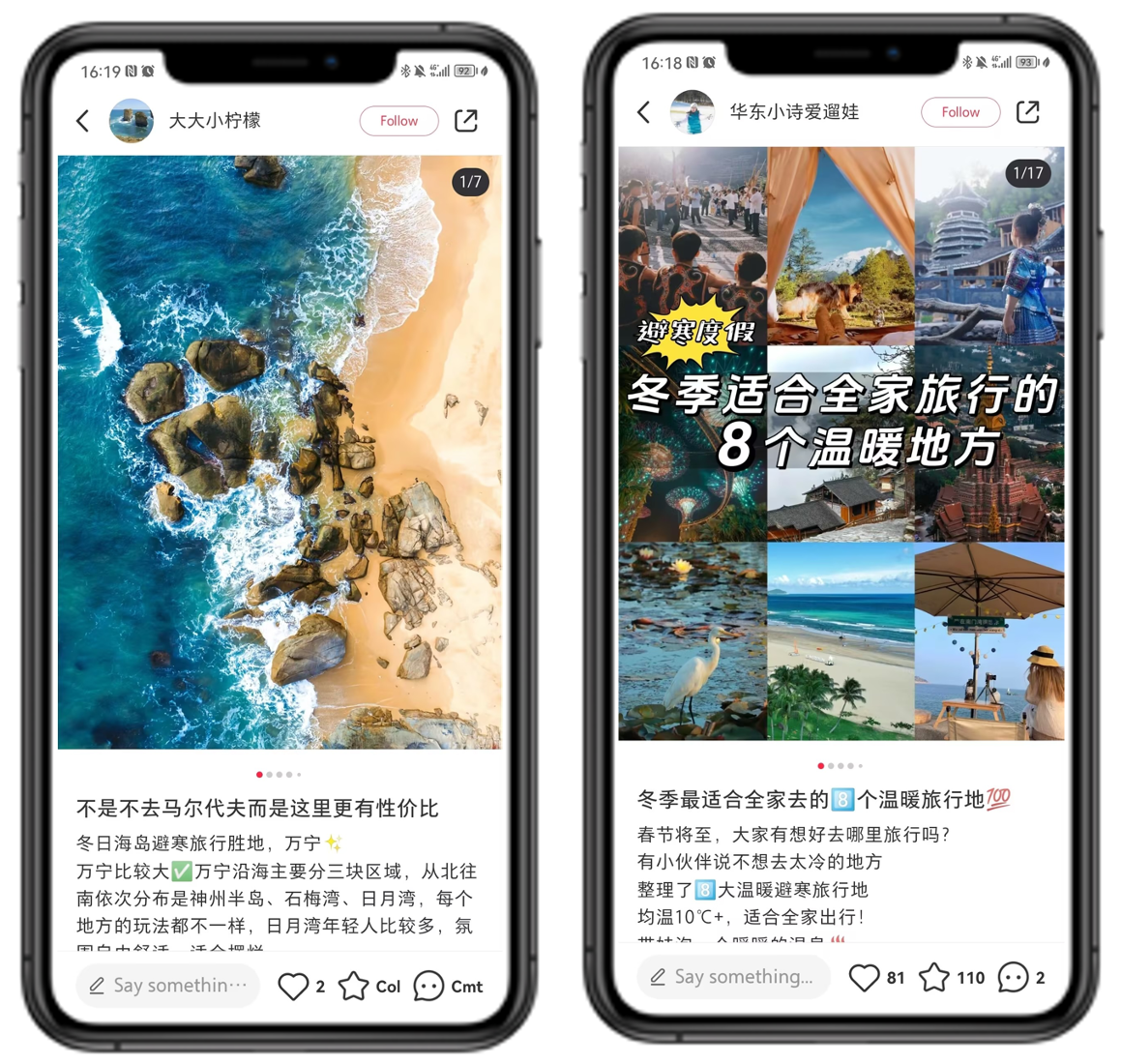

#Winter Escape

On the contrary, northern people escape the cold and travel to southern China, like Hainan Island, Yunnan Province, etc. to enjoy the warm climate.

Hainan Island has emerged as a popular winter tourist destination and a rising star in domestic luxury shopping with its unique island scenery and supportive duty-free shopping policies

Outbound Travel Trends: From Near to Far, From Pioneers to Public, High-end Experiences

From Near To Far: As International Flights Recover Slowly And Steadily, Outbound Travel Is Resuming From Short-haul Destinations To Long-haul Ones

International Flight Volumes and Recovery Rate from China in First 42 Weeks (1)

1 Data Source from CAA, pictured by CuriosityChina

There are more flight frequencies to East Asia and Southeast Asia, with further room for recovery rate improvement.

Flight recovery to European destinations has been relatively good, while flight resumption to the United States is only at around 10%.

2023 First Half Year Word Clouds of Global Destinations for Chinese Tourists (2)

2 Data Source from China Tourism Academy, pictured by CuriosityChina.

Asian countries such as Thailand, Japan, South Korea, and Singapore have become popular destinations for Chinese outbound travelers.

Long-distance travel to Europe, the United States, and the Middle East is still gradually recovering.

From Pioneers To Public: The Demographic Of Outbound Travelers Will Expand From Young Individuals From First-tier Cities To The General Public From Lower-tier Cities

1 Data Source: ChinaDaily 2 Data Source: Guangzhilv

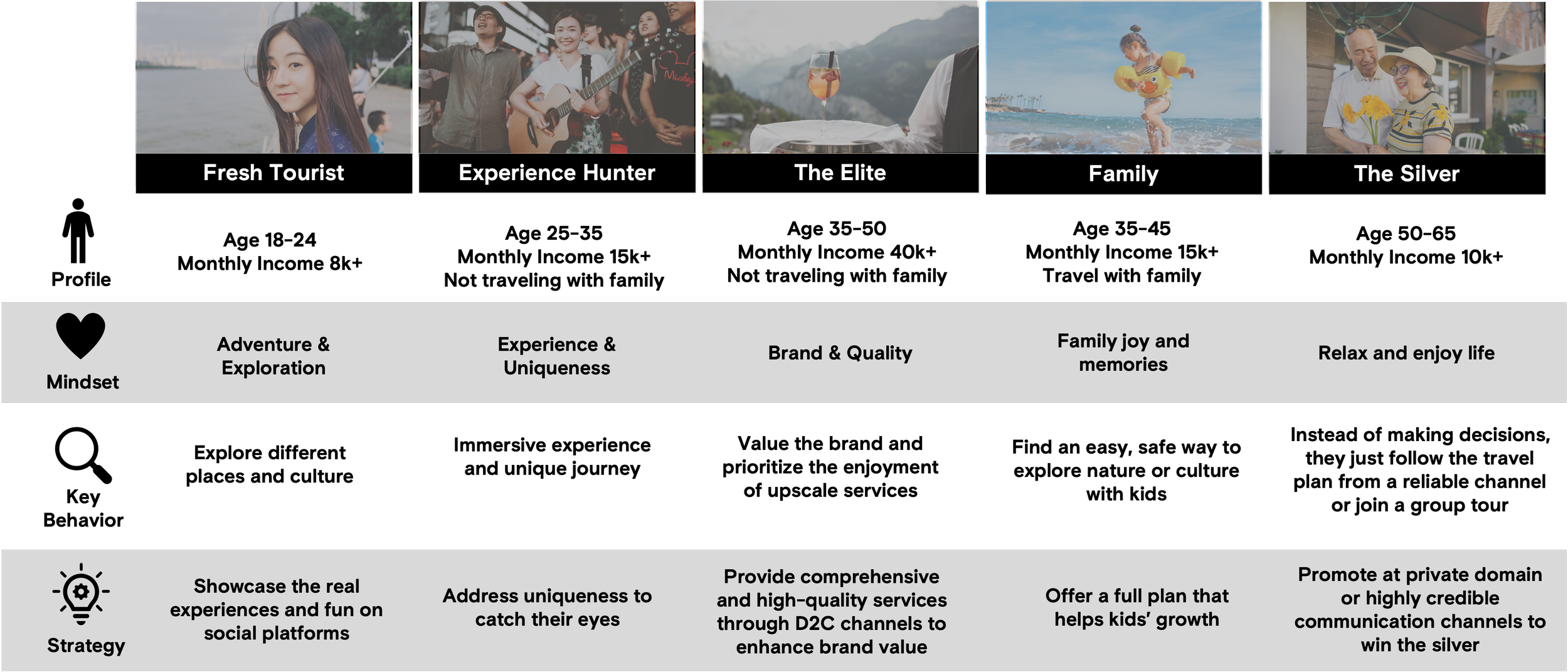

DEEP DIVE: 5 Segmentations Of Outbound Tourists

Data Source: CARAT x Trip.com Group: Chinese tourists returning to the market.

High-end, Exclusive Niche Outbound Travel Has Become A Hot Trend Among High-spending Travelers

HNWIs* are willing to engage in more luxurious travel experiences. (1)

Increased Spending

- ¥102.5k budget for travel (+15% vs 2022)

- For the survey respondents, the cohort of top 20% in terms of income allocated ¥284k budget for travel

Better Experience

- 30% plan to plan to fly first class or business class

- 50% intend to stay in upscale or luxury hotels for their next leisure trip.

Longer Time and Slower Pace

- 8.7 average visit days, +0.3 days vs 2019

- Over 70% of respondents expressed a preference for slow-paced and enriching travel experiences rather than hectic and activity-packed itineraries.

High-priced, long-duration immersive travel products are experiencing a robust recovery.

Cruise products in the Arctic and Antarctic exceeded the booking data for the same period in 2019. Summer Arctic tour products were sold out as early as May and many users have even begun booking Arctic group tours for next summer. (1)

Exquisite small-group tours, such as a 10-day trip to Iceland or an in-depth exploration of Eastern Europe, possess strong market competitiveness despite their high price points. These tours offer exceptional travel experiences, attracting the attention of high-end clientele. (2)

“Compared to 2019, the outbound travel market this year has seen a new shift towards high-end, refined, and immersive experiences.”

—— CaissaTour Assistant Vice President Ge Mu

*High Net Worth Individuals(HNWI): annual income exceeding 14 million yuan, had luxury shopping experience in the past 12 months, and had outbound travel experience before COVID-19.

1.Data Source: Finn Partners x CSG 2.Data Source: Tuniu 3.Data Source: Guangzhilv

Deep Dive on Key Travelling Spots

Fill in the form below to Download the Full Report.